Financial Independence: Money Management for Women” is a comprehensive guide aimed at empowering women to take control of their finances. It addresses unique financial challenges and provides practical strategies for budgeting, saving, investing, and retirement planning. Emphasizing financial literacy, the program offers tools and resources to help women make informed decisions and achieve long-term financial goals. By building confidence and competence in money management, this guide seeks to lead women towards financial freedom and security.

Building a Strong Financial Foundation

Building a strong financial foundation is the first step towards achieving financial independence. This involves creating a realistic budget that tracks income and expenses, allowing for better financial planning. The guide emphasizes the importance of an emergency fund, ensuring that unexpected expenses do not derail financial goals. By understanding and managing cash flow, women can create a solid base for future financial stability, making informed decisions that align with their long-term objectives.

Creating a Realistic Budget

Building a strong financial foundation starts with creating a realistic budget that accurately tracks income and expenses. This process enables effective financial planning by identifying areas for savings and investment. The guide emphasizes the importance of budgeting as a tool for achieving financial goals and managing cash flow efficiently. By outlining expenses and setting financial priorities, women can gain control over their finances and make informed decisions that support long-term financial stability and growth.

Establishing an Emergency Fund

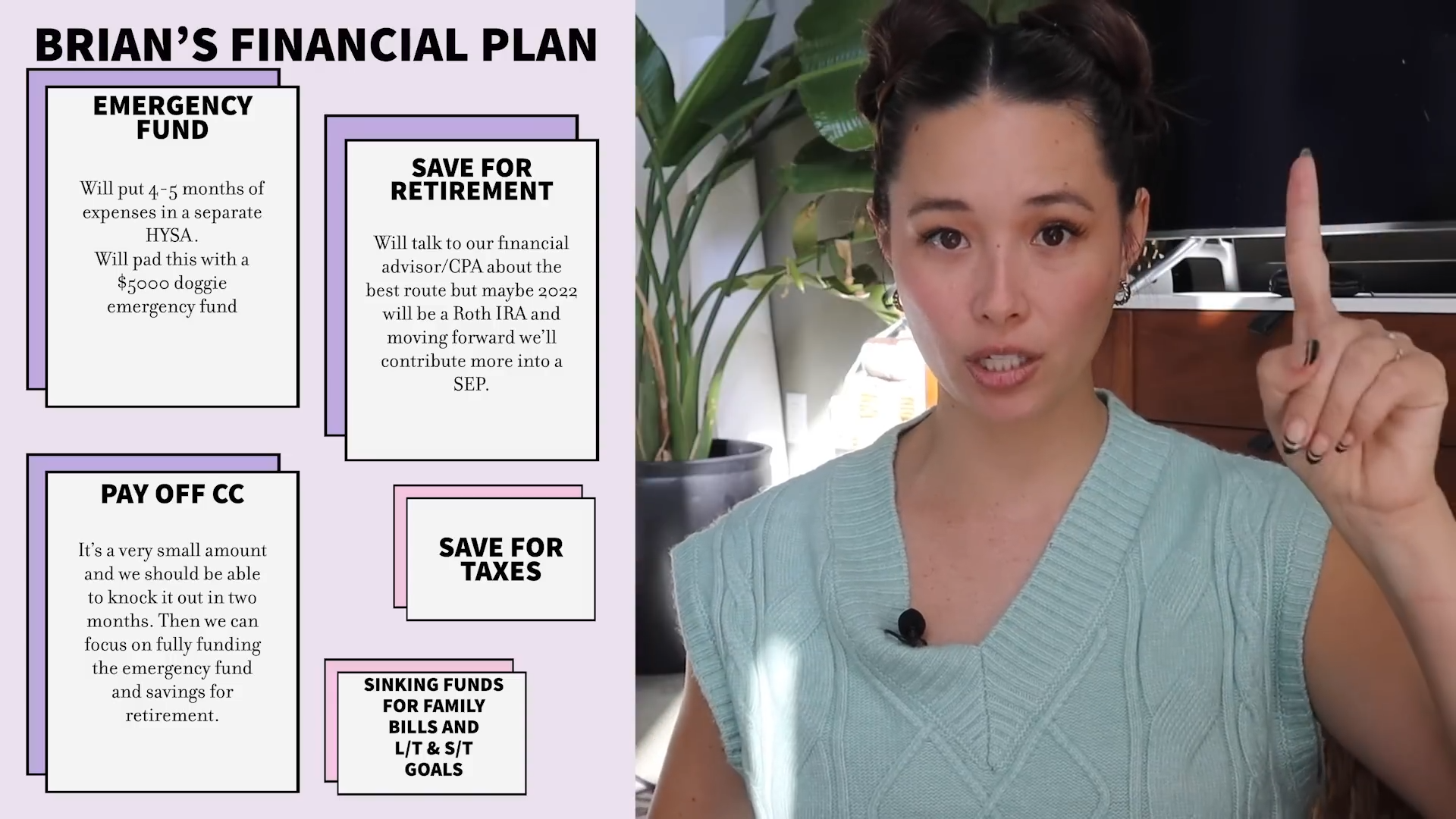

Establishing an emergency fund is crucial to protect against unexpected financial setbacks. The guide highlights the significance of setting aside savings that can cover three to six months’ worth of living expenses. This fund acts as a financial safety net, ensuring that unforeseen events like medical emergencies or job loss do not derail financial progress. By prioritizing an emergency fund, women can mitigate financial stress and maintain stability, allowing them to focus on achieving their broader financial objectives with confidence.

Smart Saving and Investing Strategies

Smart saving and investing strategies are crucial for growing wealth and securing financial independence. This guide explores various saving methods, from high-yield savings accounts to retirement plans like IRAs and 401(k)s. It also demystifies investing, explaining the basics of stocks, bonds, and mutual funds. By providing practical advice on risk management and portfolio diversification, the program helps women make informed investment choices that can lead to substantial financial growth over time.

Navigating Retirement Planning

Navigating retirement planning is essential for ensuring a comfortable and secure future. This section of the guide focuses on understanding retirement accounts, such as 401(k)s and IRAs, and the benefits they offer. It also discusses the importance of starting to save early, the power of compound interest, and strategies for maximizing contributions. By providing detailed insights and practical tips, the guide empowers women to plan effectively for retirement, ensuring long-term financial security and peace of mind.

Understanding Retirement Accounts

Understanding retirement accounts such as 401(k)s and IRAs is crucial for effective retirement planning. This section of the guide explains the benefits and features of these accounts, including tax advantages and contribution limits. By comprehending how these accounts work, women can make informed decisions about where to invest their retirement savings. The guide provides clarity on eligibility criteria and withdrawal rules, empowering women to optimize their retirement contributions and maximize long-term savings growth.

Starting Early and Harnessing Compound Interest

Starting to save early and harnessing the power of compound interest are key strategies emphasized in this guide. It underscores the importance of beginning retirement savings as soon as possible to benefit from compounded growth over time. By illustrating how small, regular contributions can grow significantly over decades, the guide motivates women to prioritize retirement planning early in their careers. Practical tips on maximizing contributions and leveraging employer matching programs further enhance the effectiveness of retirement savings strategies, ensuring a secure financial future.

Achieving Financial Independence through Strategic Money Management

Achieving financial independence requires building a strong financial foundation, implementing smart saving and investing strategies, and effectively navigating retirement planning. Creating a realistic budget and maintaining an emergency fund are fundamental steps that ensure financial stability and preparedness for unexpected expenses. By exploring various saving methods and demystifying the complexities of investing, women can make informed decisions that promote substantial financial growth. Additionally, understanding retirement accounts and the benefits of early savings helps secure a comfortable future. With practical advice and detailed insights, this guide empowers women to take control of their finances and achieve long-term financial security.